Alternatives to energy imperialism: Energy and rising economies

Western Michigan University

Paul.ciccantel[at]wmich.edu

The author would like to thank two anonymous JEH reviewers for their extensive and extremely informative suggestions. As a sociologist seeking to bring my research into dialogue with historians and others interested in energy issues, their reviews were invaluable.

Funding for this research was received from the Canadian Government’s Canadian Studies Faculty Research Grant Program, the Western Michigan University Faculty Research and Creative Activities Support Fund, and the WMU Department of Sociology.

Cet article cherche à démontrer que les efforts menés par les économies en croissance rapide pour sécuriser un accès aux ressources énergétiques ainsi que leur contrôle reposent souvent sur des alternatives à un impérialisme énergétique. Au dix-neuvième, vingtième et vingt-et-unième siècles, les économies montantes ont utilisé une variété de stratégies pour assouvir leurs besoins croissants en énergie en créant et en maintenant des flux d’énergie et de matériaux à haute intensité énergétique. Ces stratégies ont parfois donné de meilleurs termes d’échange pour les régions exportatrices de ressources. Cet article expose un modèle des stratégies d’accès à l’énergie qui ne reposent pas sur un impérialisme énergétique et présente des cas d’étude illustratifs qui explorent une large diversité de temps, d’espaces et de sources d’énergie.

Plan de l'article

- Introduction

- The Classic Model of Energy Imperialism

- Alternatives to Energy Imperialism

- U.S. Economic Ascent and Access to Canadian Energy

- Japanese Strategies to Access Raw Materials Via Alternatives to Energy Imperialism

- Chinese Alternatives to Energy Imperialism Strategies Since the 1980s Economic Opening

- Conclusion: Patterns of Alternatives to Energy Imperialism

Introduction

Energy imperialism has been an essential element of the world economy at least since the Industrial Revolution as states and firms have sought the energy resources needed to smelt metals, power factories, drive steam engines, and fuel economic development. For states lacking domestic supplies of critical energy sources, energy imperialism, defined here as the use of military, diplomatic, economic, and other forms of social power to take control of energy resources outside a state's domestic boundaries, was essential to the state's economic growth and geopolitical competitiveness.

Often, energy imperialism entailed imperial expansion efforts and warfare. Successful energy imperialist strategies restructured whole regions of the world, such as the British and French division of the Ottoman Empire after World War I to maintain control over Middle Eastern oil supplies1, although the long term geopolitical and socioeconomic consequences of these efforts still haunt the twenty-first century2. Other ultimately unsuccessful energy imperialist strategies drove conflicts that killed millions of people and had similarly long lasting consequences, such as German efforts during World War II to capture oil resources in the Middle East and Eastern Europe3 (Fritz 2011; Shirer 1959; Toprani 2019; Yergin 2011) and Japanese efforts beginning in the 1930s to control coal in Manchuria and oil in Southeast Asia4. The failed British and French Suez intervention in 1956 may have marked a key shift from energy imperialism to alternative strategies for acquiring needed energy resources, at least for rapidly growing economies5.

This paper argues that efforts to gain secure access to and control over energy resources to fuel rapidly growing economies often rely on alternatives to energy imperialism. For energy sources and energy-intensive materials such as aluminum in the nineteenth, twentieth, and twenty-first centuries, rising economies utilized a variety of strategies to supply their growing industries and energy needs. Most notably, the U.S., Japan, and China used a mix of direct foreign investment, trade agreements, joint ventures, long term contracts, infrastructural investments, and technological developments to create and maintain stable flows of coal, oil, natural gas, electricity, and energy-intensive materials from a range of resource-rich areas, including, among others, Canada, Australia, Brazil, Indonesia, and Venezuela. Moreover, these strategies sometimes resulted in better terms of trade for resource-exporting regions because of high and rapidly growing demand in these rising economies and the often weaker bargaining positions of states and firms in these ascendant economies in comparison with those of more established core states and firms. This paper articulates a model of energy access strategies that do not rely on energy imperialism and presents some illustrative case studies across a wide variety of times, places, and energy sources.

This paper draws primarily on secondary analyses of energy access strategies of rapidly growing economies and of the efforts of states with large reserves of energy resources to use these raw materials as the basis for economic development. Quantitative data on these industries, including production, consumption, and trade, are drawn from the International Energy Agency, the U.S. Energy Information Agency, the U.S. Bureau of Mines and Geological Service, the BP Statistical Review of World Energy, International Energy Agency publications, and a variety of other sources6.

The following section examines the classic model of energy imperialism via a discussion of a select set of key cases. The third section outlines the alternatives to energy imperialism model, while the following sections examine illustrative cases. In the conclusion, the paper highlights the historical patterns found in these case studies and their implications for studying energy history.

Back to topThe Classic Model of Energy Imperialism

Of all of the increasingly wide variety of raw materials needed for industrialization and economic development since the Industrial Revolution, energy sources are perhaps the most critical and fundamental. A longstanding and still rapidly growing literature examines various aspects of the central role of energy in economic development and long term social change7. Many works emphasize episodes of imperial efforts to control energy sources and the critical role of oil since the early 20th century8.

Coal became the most important source of industrial power by the beginning of the 1800s9, a role it maintained through the mid-20th century and it remains surprisingly central in the twenty-first century10. The widespread geologic availability of coal in Europe and North America made energy imperialism largely unnecessary for coal. However, there were a few key instances in which coal became of focus of imperial strategies. For example, after the development of steamships in Great Britain, Europe and the U.S. in the mid-1800s, coaling stations to fuel oceangoing steamships and access to relatively nearby coal deposits to supply these coaling stations far from the home country's coal mines became a critical concern for Great Britain, the U.S., and other nations11.

The very different geologic distribution of easily available petroleum resources, however, made oil a quintessential subject of energy imperialism, often resulting in warfare between the European powers in the first half of the twentieth century. The division of the Middle East by the United Kingdom and France following the defeat of the Ottoman Empire in World War I in order to secure access to the large oil reserves known and suspected to exist in the region was perhaps the pinnacle of naked energy imperialism. The war had demonstrated the critical role of oil as fuel for ships and land transport, while post-war geologic research in the Middle East made it clear that the two victorious powers needed secure access via colonies and client states to supply their evolving industries and economies12 and these areas would be important oil sources for the Allied war effort in World War II13. Ferguson14 argues that "as an Admiralty memorandum of 1922 put it: 'From the strategical point of view the essential thing is that Great Britain should control the territories on which the oil is situated.' Although at this time the Middle East accounted for only 5 per-cent of world output, the British were empire-building with the future in mind"15.

Other prominent examples of direct energy imperialism included Japan's acquisition of coal from Manchuria in 1930s and oil from the Dutch East Indies during the early years of World War II16. Japanese efforts at imperial conquest and their failure would make post-war efforts by the U.S. to support Japan's economic development as part of the U.S.' Cold War rivalry with the Soviet Union quite difficult, as will be discussed below.

Hitler's unsuccessful efforts to capture the Soviet Union's oil producing Baku region17 was another key example of direct energy imperialism, of the essentiality of oil for warfare since the early 20th century, and of the tremendous efforts to resist energy imperialism. It is important to note, however, that these energy imperialist efforts built directly on the long tradition of German imperialist efforts within Europe, such as battles over Silesian resources between Germany and France, and in the efforts to acquire colonies in Africa and Asia to supply the new nation of Germany in the second half of the nineteenth century18.

The widespread destruction and death that resulted from the two world wars and the declining power of the European colonial powers, however, made this strategy increasingly costly and difficult to maintain. The key marker of the end of energy imperialism might be the Suez crisis of 1956 as Britain and France decisively lost control over the region19. After Nasser nationalized the Suez Canal Company, the key transport route for Middle Eastern oil to Europe, the U.S. had refused to support British military intervention because "as President Eisenhower later asked: 'How can we possibly support Britain…if in doing so we lose the whole Arab world?'"20. The joint British and French military intervention in November 1956 without U.S. support was disastrous: "nothing could have revealed Britain's new weakness more starkly than what happened next. First, the invaders were unable to prevent the Egyptians from blocking the Canal and disrupting oil shipments through it. Then there was a run on the pound as investors bailed out. Indeed, it was at the Bank of England that the Empire was effectively lost"21. Energy imperialism had failed spectacularly.

The loss of control over this key piece of energy and general trade infrastructure emboldened anti-colonial movements against Britain and the other European colonial powers. Ferguson summarizes it succinctly: "Suez sent a signal to nationalists throughout the British Empire: the hour of freedom had struck."22 Over the next two decades, anti-colonial movements proliferated in the Middle East, Africa and Asia. The newly independent states that emerged often adopted resource nationalist development strategies in the Middle East based on oil and, more generally, resource nationalist development strategies based on taking control over oil, iron ore, bauxite, and other raw materials23. In the second half of the twentieth century, alternatives to traditional energy imperialism became an imperative for ascendant economies.

Back to topAlternatives to Energy Imperialism

The theoretical model presented in this paper rests on the theoretical and empirical analyses of the long term development and periodic restructuring of the capitalist world-economy developed by Braudel, Wallerstein, McCormick and particularly Arrighi24. Arrighi's model25 analyzes a series of four systemic cycles of accumulation over the past 800 years. Each cycle began with a period of economic and geopolitical competition that produced a new hegemon that dominated the expanding world economy but then stagnated and declined. The hegemonic cycles move from Genoa (early 1400s to early 1600s) to Holland (early 1600s to 1780s) to Great Britain (early 1800s to the 1920s) to the United States (since the 1940s) over the long term. In Arrighi's26 terms, hegemony is "the power of a state to exercise functions of leadership and governance over a system of sovereign states." Economic ascent is defined in this paper as the development of increasing economic, political and military power relative to competing states and the existing hegemon. Economic ascent to challenge the existing hegemon is a difficult and historically contingent process in which "states that have successfully seized this opportunity did so by reconstituting the world system on new and enlarged foundations"27. Arrighi28 argues that "inter-state competition has been a critical component of each and every phase of financial expansion and a major factor in the formation of those blocs of governmental and business organizations that have led the capitalist world-economy through its successive phases of material expansion."

Arrighi29 recognizes that each cycle rested on significantly intensified material production across expanded economic and geopolitical space; each cycle builds on and expands the material and spatial scale of previous cycles. Arrighi's model attributes the dynamics of these cycles to finance and politics, with capitalists in the hegemonic economy investing in newly ascending economies in order to overcome the falling rates of profit that result from accumulating excess investment in the mature hegemonic economy30. In contrast, the theoretical model presented in this paper focuses not on hegemonic decline, but instead on the role of ascending economies whose sustained growth depends on expanded and intensified material expansion and energy use to compete with the existing hegemon and other ascendant economies. Material and spatial expansion results from the efforts of ascendant economies to meet the physical requirements of the expanded production that ascendant nations must achieve before they become wealthy and powerful enough to challenge the dominance of the existing hegemon31.

The key problem for rapidly growing economies is obtaining the raw materials needed in the largest volumes to build plants, products, and transport infrastructure and to fuel economic growth. Economies of scale offer opportunities to reduce the costs of processing and transport, potentially creating competitive advantages relative to the existing hegemon and other rising economies. However, raw materials depletion and increasing distance to supplies contradict this, but offer their own opportunities for cost reducing innovations. This tension between the contradictions of scale and space is cumulatively sequential across systemic cycles of accumulation32; each ascent “raises the bar” for future ascendants organizationally, technologically, and spatially. The most dramatic and rapid processes of economic ascent restructure national economies and the world economy in support of national economic ascent, progressively globalizing the world economy and incorporating and reshaping economies, ecosystems and space33.

The challenges and the opportunities presented by the basic raw materials industries and by the transport systems on which they depend foster generative sectors: sectors that, beyond creating the backward and forward linkages that underlie the concept of a leading sector, also stimulate a broad range of technical skills and learning along with formal institutions designed and funded to promote them, vast and diversified instrumental knowledge held by interdependent specialists about the rest of the world, financial institutions adapted to the requirements of large sunk costs in a variety of social and political contexts, specific formal and informal relations between firms, sectors, and states, and the form of legal distinctions between public and private and between different levels of public jurisdiction34. These generative sectors are the key drivers of economic ascent in the world economy, providing the fundamental building blocks of economic development in the ascendant economies and, at the same time, shaping raw materials exporting regions. The concept is thus relational within a world-systems perspective35, and the outcome is that generative sectors in a rising economy will have significant consequences for economies that export raw materials or trade in other kinds of goods. In short, generative sectors provide the material building blocks, cost reductions across many sectors to increase competitiveness, and patterns of state-sector-firm relations and other institutions that combine to drive economic ascent and underdevelop raw materials extracting and exporting regions36.

However, the dynamic and contingent nature of processes of economic ascent and the resulting challenges to hegemonic control over raw materials and transport systems often engender geopolitical conflicts37. It is critical to note, however, that these processes of economic and geopolitical competition are contentious and historically contingent. The world-systems framework underlying this analysis does not mean that core actors manipulate the world like pieces on a chess board to suit their interests. Instead, their strategies and actions are shaped by the strategies of other state actors, firms, social movements, labor organizations, revolutionary groups, etc. in particular times and locations. The goal of world-systems theory is to explain the broad, long term processes across geographic regions and long periods of times. The patterns of alternatives to energy imperialism identified here are one such pattern in the operation of the capitalist world-economy as states and firms compete and cooperate and as some economies ascend to challenge existing hegemons38. The contestation over British coaling stations for steamships in the late 1800s39, for example, is an excellent empirical example of a hegemon's strategies and actions, but a case in which the hegemon is not able to impose its will because of resistance and strategic actions by other states and firms seeking to promote their own interests in the face of the hegemon's actions.

Hegemonic powers and rising challengers utilized a range of strategies in the 19th and 20th centuries to gain and/or maintain control over raw materials, sometimes successfully and sometimes resulting in abject failure and resulting economic and geopolitical decline. Energy imperialism was a common option for achieving this essential goal. The decline of European colonialism marked by the failure to reopen the Suez Canal via British and French military intervention in 195640 and the wave of anti-colonial revolutions in Africa in the 1950s and 1960s made energy imperialist strategies largely untenable, despite efforts such as the U.S. invasion of Iraq in 200441.

How can rapidly growing economies acquire the raw materials essential to sustain these generative sectors without resorting to energy imperialism, particularly in the face of domestic raw materials depletion and the resulting diseconomies of space as these raw materials must be brought from more distant areas outside the political control of the ascendant state? One critical strategy to accomplish this task has been to build new trade, transport, and investment relationships with raw materials peripheries to redirect raw materials flows away from earlier ascendant economies or the hegemon that have already undertaken the difficult and expensive tasks of building the necessary infrastructure, creating political, organizational, and legal forms that promote international trade and investment relations between a particular raw materials-producing state and the world economy, and incorporating these peripheries economically and politically into the world economy. This redirection in terms of both material flows and of economic and political relationships of a raw materials periphery (termed "stealing" in Ciccantell 200942), reduces costs and risks of meeting the ascendant economy's growing raw materials needs. Earlier processes of economic ascent progressively globalized the world economy and brought new raw materials peripheries into the global trading system to supply the earlier ascendants’ industries, so new ascendant economies and states have the opportunity initially to purchase raw materials from this established supply system43.

The newer ascendants’ rapid growth, however, means that their demand is increasing dramatically and necessitating a sharp and sustained increase in supply if these growth rates are to be sustained. The combination of the existing social and material infrastructures in the raw materials peripheries established by earlier ascendants, rapid demand growth in the ascendant economy, and the willingness of the newer ascendant economy to pay higher prices for raw materials in order to sustain their domestic growth creates an opportunity that states and firms in the raw materials periphery find very attractive. Higher prices for rapidly increasing volumes of exports (in contrast to slower demand growth in the mature economies of earlier ascendants) motivate firms and domestic elites in the periphery and even from existing core powers with fewer opportunities for profitable investments to invest in production for export to the new ascendant. States in raw materials exporting regions typically support this investment with subsidies for transport and extraction, both in an effort to promote economic development and in hopes of gaining better returns and more political freedom from the power of the existing hegemon. This is particularly apparent in postcolonial situations in which newly independent states seek to break free from neocolonial ties and in situations of resource nationalism in which states seek greater control over and benefits from raw materials exports44. Firms, elites, and states in raw materials peripheries come to see the new ascendant as a potential ally in their attempts to promote political independence and economic development45.

From the perspective of the new ascendant, building these relationships with existing raw materials peripheries is much less expensive and difficult than creating their own new peripheries. One of the most important benefits is that most of the cost and the risk of expanding extraction and transport is borne by firms and states in the extractive periphery and often by firms from the earlier ascendant. At the same time, these investments in mines and transport systems also often create opportunities for exports of industrial products from the ascendant economy to the periphery to support the development of these extractive industries and for consumption by the owners of and workers in these industries. Redirecting raw materials flow from these peripheries away earlier ascendants thus further enhances the rapid growth of the new ascendant by reducing costs and risks while simultaneously creating significant new opportunities for profit from trade and investment46.

Over the last 500 years, this process of redirecting extractive peripheries has been a key element of economic ascent in each case of rapid, transformative ascent47. For example, Holland progressively captured more and more of the Brazil trade from the waning Portuguese empire in the 1600s, taking control of much of the sugar, precious metals, and other raw materials trade and capturing the benefits of this trade for its own domestic development in shipbuilding, shipping, finance, and other industries. Great Britain rapidly displaced the Dutch from North America, the Caribbean, India and Southeast Asia in the 1700s and took control over trade in timber, sugar, and a host of other raw materials. During the postcolonial era in Latin America of the nineteenth century, Great Britain similarly displaced the Spanish empire as the region’s main trade and investment partner, inducing states to subsidize the construction of British-owned and manufactured railways to ensure high rates of profit and steady supplies of grain, beef, silver, tin and other products to British consumers and industries. The rapidly growing U.S. did the same to support its ascent in the nineteenth and twentieth centuries, displacing Great Britain first in much of North America, and later from Canada, Latin America, and the Caribbean to acquire the raw materials for U.S. industrialization. The U.S. often used the opportunity to escape British hegemony as a key enticement for firms and states to redirect their exports of copper, bauxite, and other raw materials to the U.S. market with its rapidly growing demand48. Moreover, this process has continued in the late twentieth and early twenty-first centuries, as will be discussed below in the cases of the economic ascents of Japan and China.

The most dramatic and rapid processes of economic ascent restructure national economies and the world economy in support of national economic ascent, progressively globalizing the world economy and incorporating and reshaping economies, ecosystems and space. Most of these transfers of raw materials peripheries from existing hegemons to rising economies have taken place relatively peacefully as states and firms in the existing hegemon, the rapidly rising economy, and the extractive peripheries have sought to gain economic and geopolitical advantages from these shifts in the “autumn” of the existing hegemon49. However, the dynamic and contingent nature of processes of economic ascent and the resulting challenges to hegemonic control over raw materials and transport systems can often engender geopolitical conflicts over control over particular raw materials sources and the increasingly global spaces, particularly the oceans, through which these raw materials must be moved50.

A great deal of analytic and popular attention today is directed at the issue of transitions from one energy system to another (see Podobnik51 for an early effort to analyze historical transitions in the capitalist world-economy and the need for a move away from fossil fuels). Modernization theory52 in the 1960s assumed that the progression through the stages of national economic development to developmental maturity would bring with it technological innovations, including the implementation of new energy systems. Ecological modernization53 posits a similar progression to environmental maturity at the national level, with economic development leading to increased efficiency of resource use, less waste production, and transition to progressively less polluting energy sources such as wind and solar. Other analytic models operating at an international or global level posit similar linear transitions from wood to coal to oil to renewable energy. Smil54 uses energy as a key (but not sole) explanatory factor in the long term evolution of human civilization, seeking to bring together material, technological and social processes into a linear narrative.

Smil's55 work builds on a long tradition of analyses focused on long term changes in energy use as a critical (or sometimes the critical) factor in social change56. Richard Adams'57 efforts to bring energy and power together in an energetics framework that linked natural and social processes similarly focuses on this apparent long term linear model of energetic evolution. Debeir, Deleage and Hemery58 present an earlier example of this linear energy transition model over the truly long term, with particular emphases on Chinese history and on nuclear power, the expected "next big thing" in energy terms of the mid-20th century. Podobnik's59 world-systems model of energy systems transitions posits a similar linear model60.

In some ways, this conception of linear energy transitions could be seen as closely tied to Arrighi's61 hegemonic sequences, with Holland's wood-based system followed by Great Britain's coal-based system, then the U.S.' oil-based system, and now the potentially Chinese-led renewable system. However, this linear transition model and its potential relationship to hegemonic cycles oversimplifies the relationship between energy and long term social change. These linear models of transitions do not adequately capture the energy realities of the 20th or the 21st centuries; global coal consumption has doubled in the 2000s because of China's rapid ascent fueled in large part by coal62. Rather than assuming linear energy transitions, it would be better to understand energy systems as a process of adding new energy sources to existing systems63. Oil is certainly a critical component of the world and national energy systems since the early 1900s, but the excessive focus on oil, termed "petromyopia" by Jones64 in his critique of energy analysis, has led to insufficient attention being paid to other energy sources. The fears about peak oil that emerged in the 1990s and early 2000s65 became a key justification for both wars to control oil supplies66 and for efforts to hasten the transition to renewable energy sources67. The shale revolution in the U.S. and the growth of the liquefied natural gas (LNG) trade have pushed "peak oil" off into the future and brought the U.S. back into its historic role as a major energy producer and exporter68. This reinvigoration of the U.S. oil and gas industries led the Trump Administration to proclaim U.S. energy dominance, a framing that "invites those who feel aggrieved under Obama administration regulatory policy and the multicultural identity politics of the left to renew their commitment to fossil fuels, American exceptionalism, and a restored social order and privilege"69 and that the Administration views as a new geopolitical reality.

The rest of this paper will focus more on coal and other energy sources, in part to avoid Jones' concern about petromyopia70 and in part because coal and natural gas have been and remain critical to ascendant economies and in shaping long term change in the capitalist world-economy.

Back to topU.S. Economic Ascent and Access to Canadian Energy

U.S. economic ascent and industrialization in the nineteenth century took place in the context of British hegemony, with British capital, technology, and markets for American raw materials, most notably cotton, providing critical support for U.S. economic development71. Further, other challengers also developed rapidly over the course of the 1800s, including France, Germany, Russia, and Japan, all of which needed access to growing volumes and varieties of energy and other raw materials.

The main U.S. solution during the 19th century was territorial expansion of national boundaries to incorporate new raw materials peripheries. Land was seized via warfare, forcible expulsion, and other means from Native American groups and Mexico, while other areas were purchased from France and Russia. This territorial expansion provided a wide range of resources to support U.S. industrialization, ranging from crop and grazing land to wood for construction to coal for electricity generation and metal smelting to iron and copper for construction and machinery to oil for industry and transport. The expansion of national boundaries to a continental scale by the mid-1800s largely obviated any raw materials demand-driven imperial efforts beyond these boundaries during the second half of the 1800s, despite the efforts by some business and political interests in joining the race for colonies in the 1880s and 1890s72.

Despite the abundance of coal in Appalachia, the high cost of transporting this coal to metal smelters in Montana and the Northwest led to an early alternative to energy imperialism to acquire coal and coke from coal deposits in western Canada at the turn of the twentieth century. Large deposits of metal ores in Montana, most notably copper, required smelting with coke derived from metallurgical coal to remove impurities from the metal ores, but the closest high quality metallurgical coal deposits were located just across the border with Canada in Alberta and British Columbia. The Canadian Rockies in this area contain large amounts of high quality metallurgical coal (used for producing coke to process iron ore into steel and to process other ores) and steam coal (used for generating electricity). The geologic processes that created these mountains produced this high quality coal but covered it with overburden and created coal seams that are often discontinuous and angled. Coal seams are generally quite large and lie in high (up to 11,000 feet) and extremely steep mountains. The climate is very cold and severe in the winter and, in combination with the rugged topography, the area has very limited arable land and limited timber coverage73. Further, the mountainous topography makes transporting the coal extracted difficult and expensive. The coal in the region has long been very attractive to mining and coal using firms because of these natural characteristics, but extracting and transporting the coal is challenging and costly74.

These natural characteristics, in combination with the long distances to potential coal markets, meant that coal extraction on a significant scale had to await the arrival of railroads. In the Elk Valley, the arrival of the Canadian Pacific Railway (CPR) via the Crowsnest Pass line in 189875 opened the area for coal exploration and development. Although small deposits were already known, employees of the Canadian Pacific located extensive deposits on the Alberta side of the border in the Crowsnest Pass region and in the Elk Valley on the British Columbian side of the border, as did a number of other visitors and prospectors76.

The area's proximity to the active metal mining and smelting industry of Montana and to the mainline of the Great Northern Railway (GNR) in the U.S. owned by J.J. Hill also led to exploration and coal development by affiliates of the GNR (some of the deposits Hill's affiliates developed in the Elk Valley and the Crowsnest Pass region were actually purchased from the CPR, which for a time had little interest in coal mining) and the construction of a branch line across the border to transport coal and coke to Montana and other U.S. markets77.

Once the entry of the railroads solved the transport problem, the coal industry in the region developed rapidly. The railroads themselves provided a market for coal and some of the capital needed to develop these coal deposits. Once the small initially discovered outcrops of coal had been mined, firms moved on to small and then progressively larger underground mines in the first half of the twentieth century as underground mining technology slowly increased in scale. Ownership of coal mines was almost all in the hands of external owners who used the region's naturally produced coal for their own interests, the CPR based in Toronto and the GNR with its owners based in Seattle, Spokane and Minneapolis78. The key local developmental impact of the coal mines was local processing of coal into coke in coke ovens that was then shipped to the smelters across the border in Montana79.

U.S. mining firms and railroads sought to overcome the Canadian government's objections to foreign ownership of Canadian resources and railroads by promising large investments and boosts to Canadian economic development by allowing U.S. firms to develop the mines and rail infrastructure to bring coal and coke across the border to the U.S. Despite ongoing contentious political debates, a combination of U.S. and Canadian firms developed coal mines, coke ovens, and railroads in Canada that supplied U.S. metal smelters for the first half of the twentieth century80. U.S. foreign direct investment, along with Canadian capital from the CPR, in railroads and mines developed this extractive periphery that supplied Canadian and U.S. owned smelters and railroads in Canada and the U.S. with steam coal, coking coal, and coking coal processed into coke near the mines in both British Columbia and Alberta. These coke exports to the U.S. were another alternative to energy imperialism, accommodating resource nationalism development and national unification efforts in Canada by processing a raw material locally, while relocating an energy-intensive and pollution-intensive industry to the extractive periphery in Canada.

Coal production in both southeastern British Columbia and southern Alberta faced near-extinction by the end of the 1950s after the dieselization of North American railroads and the closure of many of the smelters in western Canada and the northwestern U.S.81. As will be discussed below, this near-extinction created an opportunity for Japanese steel firms and the Japanese state to employ another alternative to energy imperialism strategy to acquire metallurgical coal from this area beginning in the 1960s82.

This alternative to energy imperialism in the western U.S. and Canada was soon replicated in the eastern U.S. and Canada with the development of the hydroelectric potential in eastern Canada, including the large hydroelectric plant at Niagara Falls in Canada and the development of the "frozen electricity" energy-intensive aluminum smelting industry in Canada. The U.S.-based Aluminum Company of America (Alcoa) created a Canadian subsidiary to use cheap Canadian hydroelectricity to produce aluminum ingot for export to the U.S., opening its first Canadian aluminum smelter in 190183, as Canadian aluminum production rose from less than 1,000 metric tons in the early 1900s to 38,000 tons in 1928, then expanded rapidly in the World War II and Korean War eras (from 75,000 tons in 1939 to 556,000 tons in 1955), with production chiefly exported to the U.S. and to Great Britain84. This relationship has continued now for more than a century. In the early 1950s, although the U.S. was the world's largest producer of aluminum, Canada supplied 73% of U.S. aluminum imports; in 1970, Canada's share was 93%, in 1994 it was 58%, and in 2016 Canada supplied 49% of U.S. aluminum imports85. U.S. direct foreign investment in aluminum in Canada was thus another alternative to energy imperialism via "frozen electricity" of aluminum ingot, accommodating Canadian economic nationalism and economic development by creating a new Canadian industry.

This cheap Canadian hydroelectricity, following the development of long distance electricity transmission infrastructure in the first third of the 20th century, itself became an important export product to the U.S. Northeast. These exports began in 1921 at 885 million kilowatt-hours, rose to 1,826 million kwh by 1938, 5,511 million kwh in 1960, and 11,409 million kwh (7,438 million net kwh after subtracting imports from the U.S. of 3,971 million kwh after the large scale integration of the regional grids in the U.S. with the Canadian grid in the 1960s86. Canadian electricity exports to the U.S. remain a critical element of the interconnected North American electrical grid87, with net exports to the U.S. in 2018 of 48 billion kwh88

The origins of the CUSFTA and NAFTA in the mid-1980s during the Reagan administration were in one sense a defensive maneuver to create a secure, continental energy market that would help the U.S. compete in the new multipolar world89. Energy trade with Canada had long been characterized by trade disputes; in periods of abundant energy supplies, U.S. energy producers had often sought to keep Canadian exports out of the U.S. market, but during periods of shortage Canada had threatened to and sometimes had cut off exports to the U.S.90 . As Drache91 has argued, "U.S. negotiators aimed for and got 'secure and enhanced access' to Canada's resource sector"92.The electricity industry was dramatically transformed by this integration between the U.S. and Canada93.

Again, this alternative to energy imperialism included both U.S. and Canadian capital and sometimes difficult and contentious negotiations between national, provincial, and state governments to build an energy supply relationship between eastern Canadian rivers with huge hydroelectric potential and the most densely populated and industrialized area of the U.S. in the first half of the 20th century, and then the integration of regional grids between the two countries94. This energy supply relationship remains vitally important to the U.S. in the twenty-first century.

Because both the coal mining regions in western Canada and the Niagara region in eastern Canada border the U.S., building the infrastructure of railroads and electric lines and the movement of capital equipment and raw materials across the border between these extractive peripheries and the U.S. was relatively straightforward, especially in comparison to building such connections across oceans. However, this redirection of these extractive peripheries from Great Britain to the U.S. was still a fraught process in political and economic terms. Canada's long history as an extractive periphery for Great Britain95 and Britain's continued reliance on this relationship, in the context of building and consolidating the unification of Canada during the late 1800s and early 1900s (British Columbia did not become a province until 1871, an agreement linked to the building of a national railway network, and Alberta did not become a province until 1905), made the British government and many governmental actors and capitalists in Canada quite wary of these new raw materials relationships with the U.S. The Canadian Pacific Railroad (CPR), long seen as a leading force in the unification of Canada in both infrastructural and political terms as it built a national railway network96, fought efforts by the U.S.-based Great Northern Railway (GNR) to link the western coalfields to the smelters in the U.S. Northwest97. The redirection of these Canadian extractive peripheries, although geographically simple, was at the time quite difficult and contested. The close integration of the U.S. and Canadian economies that emerged in the second half of the 20th century, connections that were marked by the automobile, Canada-U.S. Free Trade Agreement (CUSFTA), and North American Free Trade Agreement (NAFTA) agreements, connections that were themselves contested in Canada (perhaps most bluntly by Hurtig98 in his analysis of the CUSFTA), were rooted in these much earlier efforts to redirect Canada's extractive peripheries to supply the ascendant U.S.

In turn, the U.S. as a hegemonic power in the mid-20th century would become the broker of a new alternative to energy imperialism after World War II in pursuit of its geopolitical goal of rebuilding Japan as a bulwark against Communism in Asia. U.S. efforts to rebuild Japan after World War II and help Japan resume its economic ascent based on coal, iron ore, and other raw materials supply arrangements were even more difficult than had been the case of the relationship between Canada and the U.S. Australia and Japan had just fought a war, with the Japanese military poised to invade Australia from nearby Papua New Guinea, and the Australian government and people had not forgotten.

Back to topJapanese Strategies to Access Raw Materials Via Alternatives to Energy Imperialism

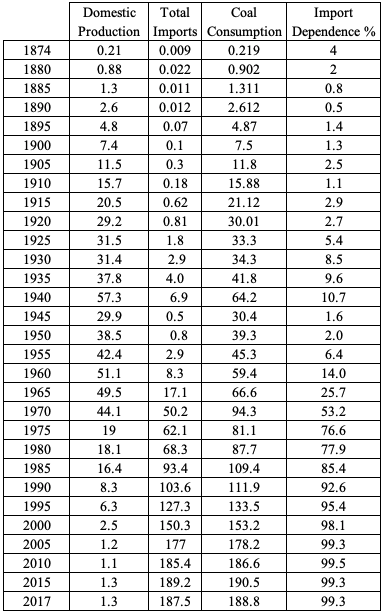

Japanese economic development from the Meiji Revolution of the 1860s through the early 1900s relied primarily on domestic raw materials. Coal production in Japan tripled during the 1880s and again in the 1890s, then doubled in the 1900s and again in the 1910s, rising from 880,000 tons in 1880 to 29.2 million tons in 1920 (see Table 1 below), reflecting Japan's rapid economic ascent and industrialization during this period. Coal imports were only a very small part of total coal consumption during this period, the result of the development of Japan's extensive domestic coal reserves. This rapid industrialization, however, depleted domestic sources, leading to a shift to direct imperial conquest of Manchuria and Southeast Asia in the 1930s and increasing reliance on imported raw materials, including metallurgical coal from Manchuria99, an example of classic energy imperialism.

Table 1 : Japanese coal production, imports and consumption.

Source: Japanese Industry 1968:34; USBM Minerals Yearbooks; IEA 1992, 1998; Japanese Economic Statistics; SCAP Natural Resources Section; IEA 2002; reproduced from Bunker and Ciccantell 2007; IEA Coal Information 2018; Mitchell 1995

Accelerated depletion of domestic coal supplies during World War II resulted in increasing technical difficulties and costs of domestic mining in the late 1940s and 1950s. Domestic metallurgical coal reserves for producing steel were almost completely exhausted. Obtaining metallurgical coal and iron ore at costs low enough to make Japanese steel production globally competitive presented key challenges for Japanese economic development and U.S. government efforts to rebuild Japan as a bulwark against communism in Asia in the context of the Cold War and the Korean War. The rapid economic ascent of Japan in the post-World War II period entailed a rapid growth in Japanese demand for coal and growing demand for imported coal100.

Japan's attempts to build a Pacific empire during World War II, combined with the onset of the Cold War and the resulting geopolitical unavailability of coal supplies from nearby Manchuria, made obtaining energy and other raw materials to support Japan's ascent incredibly difficult. From the perspective of the U.S. government, relatively nearby Australia presented the best opportunity to resolve this challenge and support Japanese economic development101. Obtaining access to Australian coal in the late 1940s and early 1950s became the first major step in creating the raw materials supply system to sustain Japan’s economic ascent. The U.S. State Department, U.S. Military Occupation Forces in Japan, the Japanese steel firms, and the Japanese state worked together to initially buy Australian coal indirectly, via U.S. military procurement channels, and then to establish direct short term and then long term supply agreements with Australian coal producers102.

The search for sources of coking coal for the steel industry became the pioneering effort in establishing Japan's raw materials access strategies based on state-sector-firm cooperation and support from the existing hegemon. No global coal market existed in the late 1940s and early 1950s. The network of coaling stations around the world established by the British empire103 and the U.S.104 had fallen into disuse after the shift to oil for marine transport in the 1920s and 1930s. The eastern coast of Australia, 3,600 nautical miles away, provided a potential solution. Both coking and steam coal existed in Australia, most of it undiscovered. The Australian state and mining firms active in Australia lacked incentives to explore for it, but Australian firms and the state governments of New South Wales and Queensland sought ways to increase steam coal exports to generate export revenues, economic growth, and employment and resolve a crisis of excess capacity and declining production and employment105.

The Australians distrusted Japanese reliability and did not plan to export metallurgical coal, the type of coal critical to Japan's steel industry and therefore its heavy industry-based development plans. From 1951 onward, U.S. State Department and other government officials in Australia promoted the idea of exporting metallurgical coal to Japan. The U.S. actively supported World Bank loans for Australian coal mines106. U.S. diplomats also consulted extensively with Australian businessmen and politicians known to favor expanded mining and export of Australian coal107. These U.S. efforts to gain Japanese access to Australian metallurgical coal finally succeeded when the U.S. devised a means of avoiding the politically sensitive problem of exporting to Japan. The Japanese Procurement Agency, a part of the U.S. Army occupation government of Japan, contracted for 100,000 tons of coking coal from Queensland in 1953108. Delivery began in 1955 and opened the door for constructing a new coal-supplying periphery for Japan. The U.S. government, pursuing its Cold War goal of rebuilding Japan, used its considerable economic and political leverage to convince an unwilling potential raw materials exporter by appealing to citizens and firms interested in exporting by funding politically appealing forms of raw materials trade relations that did not initially involve foreign direct investment by Japanese steel firms. Over the following decades, this U.S.-fostered coal supply relationship based on alternatives to energy imperialism grew rapidly109.

The Japanese steel mills and the Japanese government replicated this raw materials access strategy in western Canada beginning in the 1960s in order to reduce their very high dependence on often unstable Australian supplies and to further reduce the coal of coal imports by fostering excess capacity and competition between coal exporters. Coal production in British Columbia confronted total extinction by the early 1960s. These long term contracts in Australia and Canada embodied the state-sector-firm coordination so critical to the development of the Japanese steel industry. The long term contracts linked all the Japanese steel mills, put them on an equal footing in terms of coal access and cost, and provided an important mechanism for MITI to coordinate steel capacity and production110.

The Japanese steel mills, with the assistance first of SCAP and later of the Japanese state, thus devised a model of long term contracts to guarantee long term secure access to metallurgical coal from Australia that could be transferred to other regions, an extremely effective alternative to energy imperialism. This new model accommodated the resource nationalism of host nations. It fundamentally altered the nature and composition of the world metallurgical coal industry, transforming metallurgical coal flows from domestic movement from captive mines to their steel mill owners to transoceanic trade flows governed by long term contracts. Domestic and transnational firms assumed the capital cost and risks of opening up previously unexploited metallurgical coal deposits. Deposits that had not even been explored for earlier because of the tremendous distances between these deposits and potential markets suddenly became highly attractive. The Japanese steel mills used the market opportunities in Japan, long term contracts, and small equity investments as tools to induce mining firms in Australia and Canada to invest repeatedly in creating excess capacity in the world industry, driving down prices and the production costs of the Japanese steel mills. The Japanese steel mills refined this model during the 1970s and early 1980s in ways that made these long term contracts and the newly globalized coal industry even more favorable to the interests of the Japanese steel mills111.

The Japanese steel mills replicated this model in multiple locations during the 1970s and 1980s, creating a global excess capacity in metallurgical coal that drove down global coal prices in the late 1990s112. Intense global competition and excess capacity fomented by Japanese long term contracts lowers raw materials prices and reduces or eliminates rents (as demonstrated by the halving of real costs of importing coal into Japan between 1959 and 1998 from US$86.65 to US$43.63 in constant 1992 dollars113), putting intense pressure on exporting firms to reduce costs or face bankruptcy114.

The experience gained from accessing coking coal in Australia with minimal Japanese capital investment laid the foundation for the tremendously successful program for diversifying sources whose capital expenses were largely met by exporting states and firms: the "ABC policy (Australia, Brazil, and Canada)...a term applied to describe this approach, and to recognize the need for vigilant management of security of supply, quality, and delivery....the strategy has been clear: supply basic intermediate feedstock materials to downstream assembling and processing manufacturing industries at the lowest possible cost"115. This model, in various forms and combinations116, since the late 1940s provided the material foundations for Japan's economic ascent. The challenge of gaining access to Australia’s metallurgical coal began a learning process for the Japanese state and the Japanese steel mills on how to create the raw materials supply relations to support industrialization. Australia became the first major raw materials supplier directly dependent on Japanese markets; Brazil and Canada became during the 1960s the other two major pillars of Japan’s raw materials supply chains. Locationally, topographically, and politically, these countries presented very different sets of problems and opportunities for Japanese raw materials access strategies. In learning how to respond to and exploit these differences, the Japanese state and Japanese firms developed highly useful flexibility and agility that later serve them well in other countries117.

A very different industry provides another insightful case study of the alternatives to energy imperialism strategies developed and employed by Japanese firms and the Japanese state: aluminum. While lacking the raw material form of aluminum, bauxite ore, in its national territory, Japanese firms began developing a domestic aluminum smelting industry in the early 1900s as part of the broader process of economic development. After World War II, these firms, sometimes in partnership with the major U.S. aluminum firms, rebuilt their domestic smelting industry and relied on imports of bauxite, mainly from Australia. The oil price shocks of 1973 and 1979, however, made this energy-intensive industry (aluminum ingot is often referred to as "frozen electricity" because energy is the single most expensive input required to remove impurities and produce almost pure aluminum ingot) uncompetitive in Japan118.

The Japanese aluminum firms and MITI had a ready alternative strategy: forming joint ventures with minority Japanese ownership and signing long term contracts with state-owned firms in hydroelectric-rich countries, most importantly Brazil, Venezuela, and Indonesia. These strategies accommodated the resource nationalist policies in all three of these nations in the 1970s and 1980s, with majority ownership remaining in the hands of the exporting nations' governments and long term contracts for exports guaranteeing loans from Japan to build smelters costing hundreds of millions of dollars. Japanese aluminum firms rapidly closed their uncompetitive and often highly polluting domestic smelters and became the world's leading importers of aluminum ingot that they transformed into auto parts, construction materials, airplane components, and consumer packaging (none of which required large amounts of energy). Aluminum ingot became one of the leading export industries in Brazil, Venezuela and Indonesia during the 1980s and 1990s, although subsequent domestic issues and global aluminum price volatility have made these large investments unprofitable in many instances119.

The aluminum industry is thus a different means of accessing low cost energy resources essential to industrial production: move the production facility and much of its cost and risk to a raw materials periphery and then import the processed material. Less pollution was produced in Japan, helping resolve another major domestic issue in the 1980s and 1990s in Japan, global aluminum prices ultimately fell in relative terms, making consumption of products made from aluminum less expensive in Japan and for export from Japan, and reducing the costs and risks of this industry to Japanese firms. This Japanese strategy for raw materials access was thus successfully extended to one of the world's most energy-intensive industries, aluminum smelting, reducing the costs and risks to Japanese firms120 using this alternative to energy imperialism.

One relatively new energy industry, natural gas imports via liquefied natural gas (LNG), has been pioneered by Japanese firms in recent years. This industry is following the alternative strategies developed in coal via reliance on long term contracts, minority Japanese participation in joint ventures in exporting countries, and technological innovations in large scale, capital-intensive processing and transport that all tie exporting countries to first Japan and, in recent years, more importing countries121.The global LNG industry is very much a replication of these earlier alternative strategies.

The strategies developed to drive Japan's economic ascent with the initial support of the U.S. would be replicated in support of China's economic ascent over the last four decades.

Back to topChinese Alternatives to Energy Imperialism Strategies Since the 1980s Economic Opening

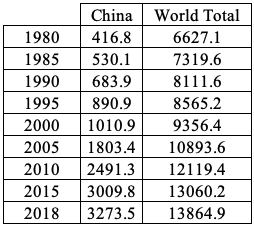

China's extremely rapid economic ascent in terms of sustained economic growth rates over the last four decades is well-known122. In material energy consumption terms, economic ascent is readily apparent. From only 6.3% of total world energy consumption in 1980, China's share rose to 23.6% in 2018. In metric tons of oil equivalent, Chinese consumption in 2018 was 7.9 times greater than in 1980, while total world consumption had only doubled (see Table 2 below). This is the essence of economic ascent: a rapidly growing economy that needs more and more resources every year to sustain its growth trajectory at a far higher rate than most other economies and than the world economy as a whole.

Table 2: China's Primary Energy Consumption.

Source: BP 2019

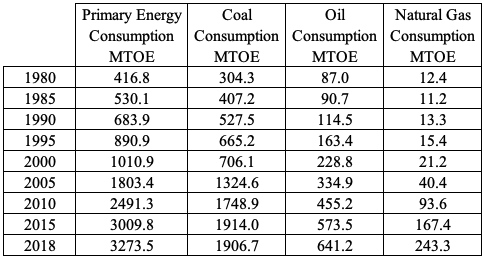

The central element of this growth of energy consumption in the late twentieth and early twenty-first centuries in China was coal. Coal consumption provided the largest share of energy to drive Chinese economic ascent (see Table 3 below).

Table 3: China's Energy Consumption by Fuel Type

Source: BP 2019

As this table shows, coal's share did fall during this rapid ascent, but only from 73% to 58.2%, despite extensive efforts by the Chinese government to promote other energy sources, including nuclear power and renewable energy such as hydroelectricity, solar and wind power. Oil consumption increased by a factor of 7.3 and natural gas consumption by a factor of 19.6, but coal remains the most important energy sector, due to China's large domestic coal reserves and the creation of a global market for seaborne coal trade by Japan's earlier economic ascent that Chinese steel mills and power companies have been able to utilize to supplement domestic production, particularly with higher quality imported metallurgical coal.

China's large, diverse land area has provided significant quantities of energy resources in addition to coal, most notably large rivers for hydroelectricity, nuclear materials, land for solar installations, and strong sustained winds for wind power generation. Even with these material advantages, rapid economic ascent made imported energy raw materials critical to China's sustained growth, as the table below shows.

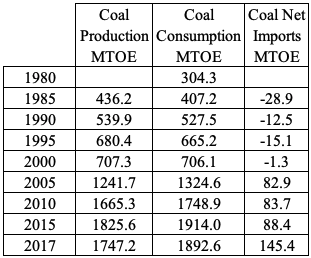

Table 4: China's Coal Production, Consumption and Trade

Source: IEA 2018

As the table above shows, in less than four decades, Chinese coal production in MTOE terms has grown by a factor of 4.6 and China has moved from a position of a net exporter of coal to a net importer, chiefly of high quality metallurgical coal from Australia and Canada because of the rapid growth of China's steel industry and depletion of domestic metallurgical coal supplies123 and of steam coal from Australia, Indonesia, and a number of other countries. Chinese steel firms are making use of the global seaborne metallurgical coal market created to serve the Japanese steel industry in the 1950s and 1960s124 to supply what is now the world's largest steel industry. The Chinese steel industry produces half of all the world's steel every year, providing the essential building block of China's rapid urbanization and infrastructure building and exporting significant quantities to other parts of the world as well.

Despite the rapid growth of the Chinese economy and the resulting growing demand for imported raw materials, Chinese firms have long complained of paying higher prices for coal, iron ore, and other raw materials than do Japanese firms and other importing countries. In iron ore, for example, in the 1990s and early 2000s Chinese steel firms typically paid US$3.50-4.00 more per ton for iron ore than did the Japanese steel firms, even though China is the world’s largest iron ore importer, because the Chinese steel firms did not coordinate their purchases125. Chinese steel firms during the 2010s have sought to replicate the Japanese model of making small foreign direct investments in coal and iron ore mines in order to reduce costs and guarantee secure access to rapidly growing volumes of these raw materials. In some cases, most notably in Africa, Chinese firms have also agreed to construct railroad and port infrastructure to move raw materials to the coast for export to China126, another alternative to energy imperialism strategy.

As was the case of British support for U.S. economic ascent and U.S. support for rebuilding Japan, the U.S. and Japan played key roles in China’s ascent as the supplier of capital and technology to the rising economy as part of what Arrighi127 analyzed as the period of financialization and decline in the existing hegemon and the efforts of financial capital in the hegemon to find new opportunities for investment in rapidly growing economies. Japanese firms played this role in the ascent of China in raw materials, transport, and many other industries in the 1990s and early 2000s. Coastal steel mills were built with technical assistance from Nippon Steel and other Japanese companies128, an explicit replication of the Japanese steel-based Maritime Industrial Development Areas program to allow imports of coal and iron ore from Australia, Canada, and Brazil. Japanese steel firms are joint venture partners in several steel mills and steel processing plants129, supplying capital and technology to their Chinese partners. In other raw materials industries, a wide variety of Japanese raw materials processing firms, trading companies and banks played similar roles130. Most significantly, China followed the Japanese model of coastal greenfield heavy industrialization to supply other industries at low cost131 as state policies focus on deepening industrialization in steel, shipbuilding, and other heavy industries via reliance on rapidly growing volumes of imported raw materials.

A close cooperative relationship between the U.S. and China supported China’s economic ascent over the past four decades. Shared opposition to the Soviet Union led the U.S. and China to form what Henry Kissinger referred to as a ”tacit alliance” by 1973 during which “Washington proceeded to support, arm, share intelligence with and nurture the economy of a Chinese government it had previously attempted to overthrow”132. The U.S. government supported China’s military modernization and, via granting Most Favored Nation trading status to China, supported the origin and development of China’s export-led development strategy133. Further, another analyst argued that “the training of People’s Republic of China (PRC) students and scholars in the West, most importantly in the United States, by itself constitutes the most significant transfer of technology to one country in a short period of time ever. Without doubt, over the past four decades, China has obtained what it needed for its economic modernization from abroad (capital, technology and access to markets) in greater amounts and at less cost than any country previously”134. This tacit alliance played a critical role in helping the U.S. in its geopolitical rivalry with its most formidable political rival of the mid-twentieth century, the Soviet Union, but, just as was the case of Japan-U.S. relations after World War II, led to the dramatic rise of a new economic and political ally and rival that transformed the world economy. As in the earlier cases of rapid and systemically transformative economic ascent, the existing hegemon unintentionally created a major new rival135, a rivalry clearly demonstrated by the Trump Administration-initiated trade war with China.

As is the case in Japan, the Chinese state is also supporting efforts to import LNG. Because China does possess large domestic natural gas reserves as well, extensive efforts are being made to increase natural gas extraction and transport domestically, including via the introduction of hydraulic fracturing technology from the U.S. The ongoing trade war with China is raising concerns in late 2019 that U.S. LNG exports to China and the pace of developing new LNG export facilities will be slowed by the 10% tariff imposed by China in September 2018136 and then the 25% retaliatory tariffs the Chinese government imposed on U.S. LNG in June 2019137. The 10% tariff sharply reduced Chinese imports of U.S. LNG from 23 cargoes in the first four months of 2018 to only four cargoes in the same period in 2019138. As one industry trade group official noted, "what we are seeing is the interconnectivity of policy that has nothing to do with gas, impacting gas. We are collateral damage"139. In short, the escalating U.S.-China trade war is already claiming a victim in one of the fastest-growing U.S. export industries, one that has received significant support from the Trump Administration for its role as "freedom gas" and a major new export industry140. This alternative to energy imperialism has thus become a hostage in the broader geopolitical and economic rivalry between the U.S. and China.

It is important to note that, despite the Trump Administration's focus on China as an economic and geopolitical rival in recent years, the analysis of China's economic ascent does not necessarily mean that it can or will challenge the U.S. for hegemony. This is in fact a hotly debated topic across a variety of disciplines, with some analysts convinced that China will succeed the U.S. as hegemon141, some who see it as possible142, and some who are convinced that China's ascent will not end in a new hegemony143. However, it is very clear that China's economic ascent and the resulting demand for energy and other raw materials are transforming many regions of the world economy into extractive peripheries supporting China's economic ascent144.

Back to topConclusion: Patterns of Alternatives to Energy Imperialism

Rapid economic growth in ascendant economies makes access to increasingly large and diverse flows of energy raw materials essential for sustained economic development. One historical option to accomplish this task has been energy imperialism, but the socioeconomic and geopolitical changes of the second half of the twentieth century have made that model of dubious value in recent decades. There is a long history of alternatives to energy imperialism, dating back at least to the late 1800s and the process of U.S. economic ascent that relied in part on energy trade relationships with Canada. The Suez Crisis of 1956 may serve as the marker of a new era in which energy imperialism has become extremely difficult and costly.

Over the past century and a half, several patterns of alternatives to energy imperialism have developed in rapidly ascending economies, including the U.S., Japan, and China:

- Redirecting material flows from existing raw materials peripheries from earlier ascendant economies, e.g. the U.S. eventually reorienting Canada to supply its needs rather than Great Britain, Japan and Australian coal;

- Paying higher prices for imported raw materials to gain access to needed resources, e.g. Japan and coal in Australia and Canada in the 1960s and 1970s, China in the 1990s and 2000s;

- Building large scale transportation infrastructure to lower transport costs and tie exporting countries with matched large infrastructure to the importing country, e.g. Japan and China with large ore carriers for coal, the U.S. and China building railroads in extractive peripheries;

- Technological innovations in larger scale, more energy efficient energy consuming industries, e.g. steel mills in Japan that were replicated in China;

- Long term contracts to induce exporting nations and firms to invest in infrastructure and mines, lessening the capital requirements for importing states and firms, e.g. railroads and ports in Australia and Canada for coal export, aluminum smelters and hydroelectric dams to export aluminum to Japan;

- Joint ventures with minority foreign ownership by firms in ascendant economies, transferring part of the cost and risk to states and firms in the exporting periphery and accommodating resource nationalist development efforts in the periphery, e.g. coal in Australia with Japanese and Chinese firms, aluminum smelters to Brazil, Venezuela, and Indonesia with Japanese firms; and,

- Relocating energy-intensive industries like aluminum to energy resource-rich and resource nationalist energy-rich countries, e.g. aluminum smelters from Japan to Brazil, Venezuela and Indonesia.

The alternative strategies to energy imperialism developed in the coal industry now appear to be replicated in the newest form of long distance energy trade, liquefied natural gas, with consuming countries with growing energy demand and limited or nonexistent domestic supplies investing in large scale, capital-intensive, and specialized infrastructure that must be in place on both ends of the voyage, signing long term contracts to guarantee supplies, and forming joint ventures with minority foreign ownership to accommodate resource nationalist policies in exporting countries145.

The findings from these case studies call into question several assumptions about the role of energy in long term social change. For example, coal is typically viewed as the quintessential 19th century energy source that was rapidly displaced by oil in the 20th century146. However, over the long term, this transition narrative is highly misleading; the two most rapid and transformative cases of economic ascent in the late twentieth and early twenty-first centuries, the post-World War II reconstruction of Japan and the rise of China since the 1980s, both relied fundamentally on coal to fuel their steel and electricity industries. Global coal production, driven by demand in China, in fact doubled during the first two decades of the twenty-first century147. Learning how to acquire coal imported from distant mining regions shaped the broader patterns of economic ascent in Japan with assistance from the U.S., patterns that were replicated with help from Japan and the U.S. in China. Moreover, in the wake of the two oil price shocks, political instability of Middle Eastern oil supplies, and price volatility in the 1990s and 2000s148, coal became even more attractive as an energy source, despite its large contribution to climate change. Oil was only part of a broader suite of diverse energy sources sought by rapidly growing economies in order to sustain economic development, sometimes via energy imperialism but often via the alternative strategies that are the focus of this paper.

In short, the age of energy imperialism is likely to be past. In fact, as was recently noted in opinion piece in The Washington Post about President Trump's desire to keep the oil in Syria by a former war crimes prosecutor, "keeping Syria's oil could well constitute pillage-theft during war-which is banned in Article 33 of the Fourth Geneva Convention and the 1907 Hague Laws and Customs of War on Land…the prohibition has a solid grounding in the laws of war and international criminal justice, and the U.S. federal code, including as a sanction for the illegal exploitation of natural resources such as oil from war zones"149. The alternative strategies that have developed since the late 1800s analyzed here may prove to be the future of the global energy system, at least as long as fossil fuels remain essential to the world economy.

- 1. Marian Kent, Moguls and Mandarins: Oil, Imperialism, and the Middle East in British Foreign Policy, 1900-1940 (London: Frank Cass, 1993); William Stivers. Supremacy and Oil: Iraq, Turkey, and the Anglo-American World Order, 1918-1930 (Ithaca, NY: Cornell University Press, 1982); Kristian Ulrichsen, The First World War in the Middle East (London: Hurst & Co., 2014).

- 2. Michael Klare, Blood and Oil (New York: Metropolitan Books, 2004).

- 3. Stephen Fritz, Ostkrieg: Hitler’s War of Extermination in the East (Lexington, KY: University Press of Kentucky, 2011); William Shirer, The Rise and Fall of the Third Reich: A History of Nazi Germany (New York: Simon & Schuster, 1959); Anand Toprani, “’Our Efforts Have Deteriorated Into a Contest For Dollars.’ The ‘Revolt of the Admirals’ NSC-68, and the Political Economy of the Cold War” Diplomacy and Statecraft vol. 30, 2019, 681-706; Daniel Yergin, The Quest: Energy, Security, and the Remaking of the Modern World (New York: Penguin Press, 2011).

- 4. Timothy Lehmann, For Profit or Power? The Strategic Purpose of Economic Exchange in the U.S.-Japan Great Power Rivalry (Ph.D. Dissertation, Ohio State University, 2002); Michael Barnhart, Japan Prepares for Total War: The Search for Economic Security, 1919-1941 (Ithaca, NY: Cornell University Press, 1987); Alvin So, East Asia and the World Economy (Thousand Oaks, CA: Sage, 1995); Stephen G. Bunker and Paul S. Ciccantell, East Asia and the Global Economy: Japan’s Ascent, with Implications for China’s Future (Baltimore, MD: The Johns Hopkins University Press, 2007).

- 5. Steven Galpern, Money, Oil, and Empire in the Middle East: Sterling and Postwar Imperialism, 1944-1971 (New York: Cambridge University Press, 2009); Hugh Thomas, Suez (New York: Harper Colophon, 1966); Donald Neff, Warriors at Suez: Eisenhower Takes America into the Middle East (New York: Simon & Schuster, 1981); Niall Ferguson, Empire: The Rise and Demise of the British World Order and the Lessons for Global Power (New York: Basic Books, 2002).

- 6. B.R. Mitchell, International Historical Statistics: The Americas 1750-1993 (4th ed.) (New York: Macmillan Reference, 1998); F. Leacy, Historical Statistics of Canada (2nd edition) (Ottawa: Government of Canada, 1983); Joel Darmstadter et al., Energy in the World Economy: A Statistical Review of Trends in Output, Trade, and Consumption Since 1925 (Baltimore: The Johns Hopkins University Press, 1971).

- 7. Eugene Staley, Raw Materials in Peace and War (New York: Council on Foreign Relations, 1937); Richard Adams, Energy & Structure: A Theory of Social Power (Austin: University of Texas Press, 1975) ; Richard Adams, Paradoxical Harvest: Energy and Explanation in British History, 1870-1914 (Cambridge: Cambridge University Press, 1982); Richard Adams, The Eighth Day: Social Evolution as the Self-Organization of Energy (Austin: University of Texas Press, 1988); Jean-Claude Debeir et alii. In the Servitude of Power: Energy and Civilization Through the Ages (London: Zed Books, 1991); Vaclav Smil, Energy and Civilization: A History (Cambridge, MA: MIT Press, 2017); Andreas Malm, Fossil Capital: The Rise of Steam Power and the Roots of Global Warming (New York: Verso, 2016); Timothy Mitchell, Carbon Democracy: Political Power in the Age of Oil (London: Verso, 2011); Daniel Yergin, The Prize: The Epic Quest for Oil, Money and Power (New York: Simon & Schuster, 1991); Michael Klare, Resource Wars: The New Landscape of Global Conflict (New York: Metropolitan Books, 2001); Michael Klare, Rising Powers, Shrinking Planet: The New Geopolitics of Energy (New York: Metropolitan Books, 2008); Richard Rhodes, Energy: A Human History (New York: Simon and Schuster, 2018); E.A. Wrigley, Energy and the English Industrial Revolution (Cambridge: Cambridge University Press, 2010).

- 8. Christopher Clark, Iron Kingdom: The Rise and Downfall of Prussia, 1600-1947 (Cambridge, MA: Belknap Press, 2006); Mitchell, Carbon Democracy: Political Power in the Age of Oil (cf. note 7) ; Yergin, The Prize: The Epic Quest for Oil, Money and Power (cf. note 7); Klare, Resource Wars: The New Landscape of Global Conflict (cf. note 7); Klare, Rising Powers, Shrinking Planet: The New Geopolitics of Energy (cf. note 7); David Harvey, The New Imperialism (Oxford: Oxford University Press, 2003).

- 9. Malm, Fossil Capital: The Rise of Steam Power and the Roots of Global Warming (cf. note 7).

- 10. Paul S. Ciccantell and Paul Gellert, "Chapter 7. Raw Materialism and Socio-Economic Change in the Coal Industry", in Debra Davidson and Matthias Gross (eds.) Oxford Handbook of Energy and Society (Oxford: Oxford University Press, 2018), 113-136.

- 11. On Barak, "Outsourcing: Energy and Empire in the Age of Coal, 1820-1911", International Journal of Middle East Studies vol. 47, 2015, 425-445; Bernard Brodie, Sea Power in the Machine Age (Princeton, NJ: Princeton University Press. 1941); Steven Gray, Steam Power and Sea Power: Coal, The Royal Navy, and the British Empire, c. 1870-1914 (London: Palgrave Macmillan, 2017); Peter Shulman, Coal & Empire: The Birth of Energy Security in Industrial America (Baltimore: Johns Hopkins University Press, 2015).

- 12. Toprani “’Our Efforts Have Deteriorated Into a Contest For Dollars.’ The ‘Revolt of the Admirals’ NSC-68, and the Political Economy of the Cold War” (cf. note 3); Ulrichsen, The First World War in the Middle East (cf. note 1); Efraim Karsh and Inari Karsh, Empires of the Sand: The Struggle for Mastery in the Middle East 1789-1923 (Cambridge, MA: Harvard University Press, 1999).

- 13. David Edgerton, Britain's War Machine: Weapons, Resources, and Experts in the Second World War (Oxford: Oxford University Press, 2011).

- 14. Ferguson, Empire: The Rise and Demise of the British World Order and the Lessons for Global Power (cf. note 5).

- 15. Ibid., 263.

- 16. Raymond Vernon, Two Hungry Giants: The United States and Japan in the Quest for Oil and Ores (Cambridge, MA: Harvard University Press, 1983); So, East Asia and the World Economy (cf. note 4); Rajaram Panda, Pacific Partnership: Japan-Australia Resource Diplomacy (Rohtak, India: Manthan Publications, 1982); Edward Ackerman, Japan's Natural Resources and Their Relation to Japan's Economic Future (Chicago: University of Chicago Press, 1953); Barnhart, Japan Prepares for Total War: The Search for Economic Security, 1919-1941 (cf. note 4); W. Ball, Japan-Enemy or Ally? (New York: John Day Company, 1949).

- 17. Toprani “’Our Efforts Have Deteriorated Into a Contest For Dollars.’ The ‘Revolt of the Admirals’ NSC-68, and the Political Economy of the Cold War” (cf. note 3); Shirer The Rise and Fall of the Third Reich: A History of Nazi Germany (cf. note 3); Yergin The Prize: The Epic Quest for Oil, Money and Power (cf. note 7).